| Panel | |

|---|---|

|

...

The Processing/Process Outstanding Payables option lists all Unpaid Payables from prior payrolls. Once the payables are selected, click on to USAS to assign the ET * and Check numbers for the Payables. A Payables Payment Reports gets created. To view these reports, they will be saved under 'File Archive', Payee Payment Detail'.

To clear Board Paid payables from the Outstanding Payables grid, select the payable to process as a normal payable. No check or ET will be created since it will be a zero amount. These reports will move to File Archive under 'Payee Payment Detail' with full detail:

Payable Reports

...

If wanting to add a Page Break by Payroll Items, select:

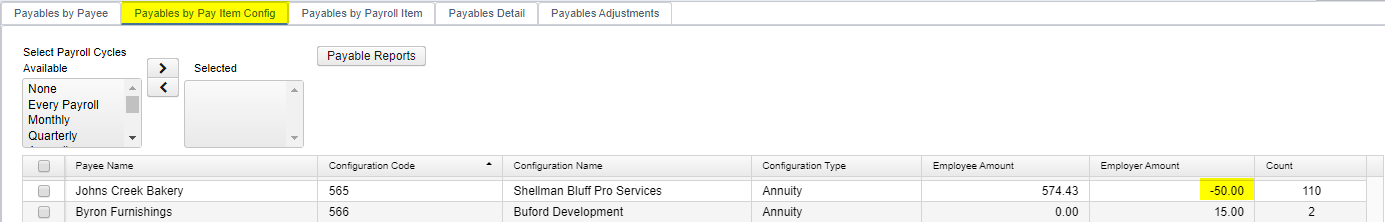

If you select one of the 'Available' options, only those Unpaid Payable's will show in the grid below: (This is all Unpaid Payables up to Current date)

...

Payables Detail Report.pdf

Payables Detail Report.csv

Payables Detail Report.xlsx

Payables Summary Report.pdf

...

Payables Summary Report.xlsx

Payables by Payee

The Payables by Payee option allows you to select and pay Unpaid Payables from prior Payroll Cycles. The Payables by Payee will be grouped together by the Payee Name, also displaying are the Code, Employee Amount and Employer Amount.

...

Select the Payroll Item using the drop drop down box or type in payroll item code or type.

Enter in the Employee Amount to to be adjusted.

Enter in the Employer Amount to be adjusted.

A Description can be entered to describe the adjustment amount.

Once completed, click on or to not save and exit.

...

The Payable Adjustment will now be included in the Outstanding Payables to be paid:

If Employee is on leave and pays for Insurance out-of-pocket to the district

1. Deposit the check into the PAYROLL CLEARANCE account.

2. Go PROCESSING>PROCESSING OUTSTANDING PAYABLES>PAYABLES ADJUSTMENT tab. Enter the check amount as a positive for payment.

3. Generate the report and ensure the employee is on the report.

Outstanding Payables>Payables by Payroll Item:

4. To ensure W2 Employer Health Coverage is correct, use Core>Adjustment>Health Insurance to add the amount ONLY paid out of pocket from the employee. The amount already deducted from previous pays, will be added to this amount:

W2 Report

Posting Errors

Error - Duplicate check number already posted, ensure check number is unique.