Payroll Accounts - New contains pay account records for each Compensation that is entered. When a payroll is processed the accounts entered in Payroll Accounts option are used to complete the USAS charging of the payroll.

If an Expenditure account has not yet been created in USAS-R, it must exist first before adding it in USPS-R Payroll Accounts. If an expenditure payroll account has a status of “Inactive” in the USAS-R application, it will not show in the drop-down box as available when creating a new payroll account on an employee’s compensation. Accounts that have an “Inactive” status in USAS-R, may still show on an employee’s payroll account or compensation history, and can be made “Inactive” in USPS-R under Payroll Accounts. The USAS-R account status may be inactive does not remove it from any posted payroll history.

Search/View Payroll Accounts

The Payroll Accounts Grid allows the user to search for existing employee Accounts. You can either enter in the Number or a few characters in any of the grid headings and all occurrences of that search will show up and then you can choose the item(s) you are wanting to view or edit. Example - First Name is one of my grid options. If I type in %San% (% is use as a wildcard) in the First name field, all occurrences of anyone with 'San' in the first name will appear. You can then click on the next to the Payroll Account record you are searching for to view the data relating to this employee or click on the to edit the record or to delete the record:

Include Archived Employees

To include archived employees in the grid, click on .

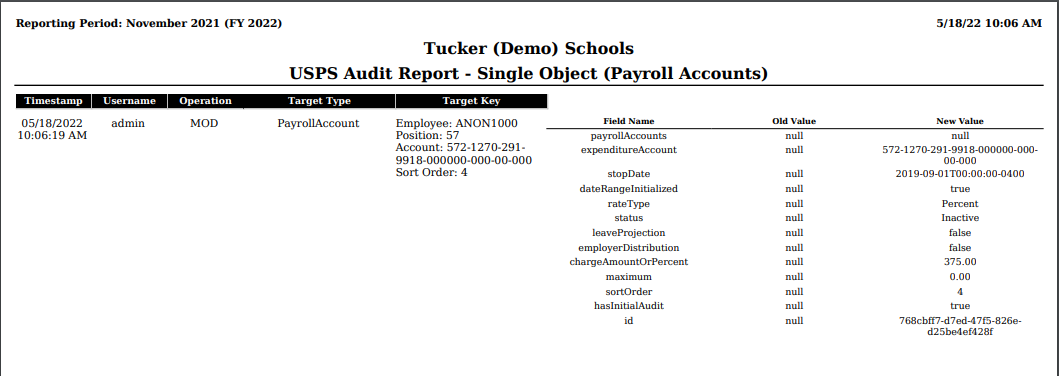

Audit Report option after creating/editing Payroll Accounts

After creating and saving a Payroll Accounts record, or to see any changes that were made to a Payroll Accounts record, there is an option to run an Audit Report directly

from the Payroll Accounts record.

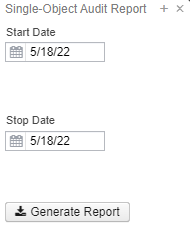

User must be in VIEW mode in order to see the Audit Report button. On the Payroll Accounts record–Click on the button.

Click on the

Create Payroll Accounts

Info Message will appear if the Payroll Account is already created for this employee. Will take you to Edit mode:

To create a new pay account for an employee, the employee and Position number must already exist.

Click on

Select the Employee by typing in the employee's name or enter a part of the name to bring up any employee with those letters in their name and enter a Position number to add the new Payroll Account and click on :

Employee

Position

Click on to add a new Payroll Accounts:

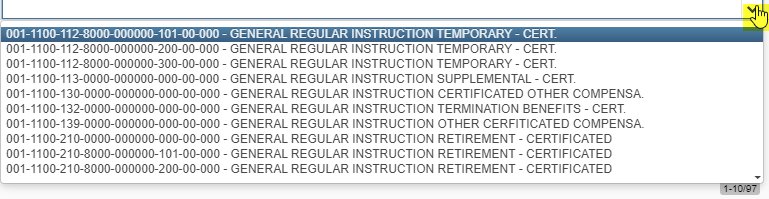

- Select the Expenditure Account by clicking on the or by entering in a portion of the account to narrow your search for Example: 001:

2. The Rate Type refers to the method by which this account is to be charged:

- Percent - indicates a percentage of gross to be charged to this account.

- Fixed - indicates a fixed dollar amount to be charged to the account:

- Restrictions on the use of the Fixed Option are as follows:

- The purpose of the Fixed Option is to accommodate special funding where a set amount is to be charged to a particular account for a job.

- Pay accounts for each job must total 100 percent. Therefore if a fixed rate is used, there must be at least one percentage rate record on file for the job totaling 100 percent. Failure to have a percentage rate record or records totaling 100 percent will result in the job not being included in the payroll. Users will receive a warning message in this case.

- Active fixed rate accounts for a job will be charged first. Once the fixed amount is charged, the active percentage rate account or accounts are then charged based on the percentages assigned.

- Benefits (sick, vacation, jury duty etc.) will not be charged to a fixed amount account.

- Restrictions on the use of the Fixed Option are as follows:

3. The Charge Amount or Percent is the percentage or fixed amount that is to be charged to this account. Whether a percentage or fixed amount is entered is dependent on what is entered in the Percent or fixed field.