Account Change Request

Allows you to change expenditure and revenue account codes. As these account codes are changed, the original accounts will remain on the system but with an inactive status. User is restricted from applying a new Account Change job if an existing account change job is currently in progress. Error message will indicate that an Existing Account Change job is currently in progress.

When the account change is processed, it changes related transactions and figures for the current FY only and preserves the prior year transactions and account figures for the old account so that accurate historical reports can be run retroactively for prior fiscal years.

Account Synchronization

When the USPS-R Account Synchronization is performed, accounts that have been processed through Account Change will be updated from the previous account to the new account in the USPS-R Payroll Accounts.

Restrictions:

- The 'From' account and the 'To' account's SCC must be in the same range (0000-8999) or (9xxx).If the SCC on the old account is between 0000-8999, this account belongs to a fund with a SCC of 0000 so the new account must also have a SCC between 0000-8999. Example: An 009 5000 expenditure account is part of the 009 0000 cash account. It can't be changed to an 009 9xxx cash account.

- The 'From' account and the 'To' account must have the same Fund. You cannot cross funds. The old and new account must belong to the same cash account.

Warnings:

- You will be crossing appropriation boundaries. The new account is in a different appropriation account than the old account. The appropriation account balances will be adjusted to correspond to the budget account changes made.

When filtering for a specific expenditure account or revenue account, enter "02/" before the entry of an expenditure account and "03/" before the entry of a revenue account to help with filtering. i.e. by entering 02/001-2500-5 the system will start to display your expenditure accounts with the function of 2500 and any 500 object codes.

Collapsing an account into a new account code

If the new account you want to merge the old account into does not currently exist on the system, you must create the account first. The steps below are used to account change an existing expenditure account into a new expenditure account that doesn't currently exist.

- From the Utilities menu select 'Account Change'

- Click on

- Enter in the required information needed to create a new expenditure account.

- Click on to create your account code change.

- Select the Fiscal Year

- Enter the 'From Account'

- Enter the 'To Account' (the account you just created)

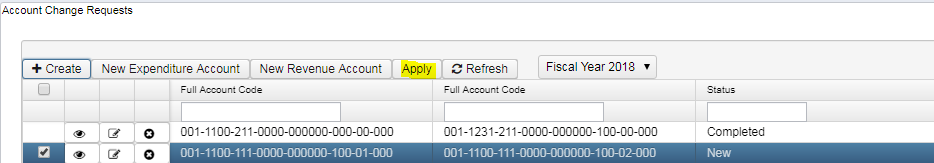

- Click on to start the account change process or click on to not create the account change. The account change request will appear on the Grid with a 'New' status.

- Once all account change requests have been entered, checkmark all account change requests to be processed and click on to start the account change process. You can click on to refresh the status of the change. Once the change is finished, the status should display 'completed' and the 'From Account' will be set to an inactive status and all corresponding transactions will point to the 'To Account'.

Collapsing an account into an existing account code

If the new account you want to merge the old account into does currently exist on the system, you do not need to create an account first. The steps below are used to merge an existing expenditure account into another existing expenditure account.

- Click on to create your account code change.

- Select the Fiscal Year

- Enter the 'From Account'

- Enter the 'To Account' (the account you just created)

- Click on to start the account change process or click on to not create the account change. The account change request will appear on the Grid with a 'New' status.

- Once all account change requests have been entered, checkmark all account change requests to be processed and click on to start the account change process. An Information message will be displayed stating the account change job has started. You can click on to update the status of the change. Once the change is finished, the status will change from 'in progress' to 'completed' and the 'From Account' will be set to an inactive status and all corresponding transactions will point to the 'To Account'.

Search an Account Change Request

The account change requests grid allows the user to search for existing account change entries by clicking in the filter row in the grid columns and entering in the desired information. Click on any row of the search results to see a summary view of the record. The Advanced Search can be utilized by clicking on the in the upper right side of the grid.

Edit an Account Change Request

Click on in the grid beside the account change request to edit the request. Only requests with a status of 'New' or 'Completed' may edited.

Delete Account Change Request

Click on in the grid beside the account change request that needs to be deleted . A confirmation box will appear asking to confirm that the account change request should be deleted. Only requests that are 'New' or 'Completed' may deleted.

More Information

An optional rule (org.ssdt_ohio.usas.model.accountChange.AccountChangeRequestFiscalYear) is enabled (by default) that will provide an error message upon creation of an account change request when the prior fiscal year is open. The rule may be disabled via SYSTEM/Rules.