Budgeting Scenario Steps for creating proposed amounts for the next fiscal year

The Budgeting Process contains two programs:

- Scenarios: Allows for the creation of a budget scenario via spreadsheets which are then promoted to proposed amounts.

- Proposed Amounts: Once promoted, the budget and revenue amounts are displayed in the proposed amounts grid to allow for further changes. Once ready, they will be applied as initial budget and revenue estimates as either temporary or permanent appropriations.

For further information on the Budgeting process, please refer to the Scenarios and Proposed Amounts sections of the Budgeting chapter in the USAS-R manual.

Scenarios

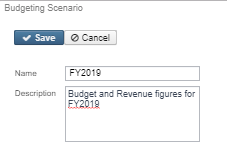

- Click on Budgeting → Scenario → Create to create a Scenario

- Enter Name → Description →

- Click Save to save the Scenario or continue on to create or upload sheets. Remember to ‘Save’ the scenario when finished

OR

- From the Scenario Grid, query an existing Scenario you want to Clone

- Click on to view the Scenario

- Click on . All accounts associated from the existing scenario will be copied to the new scenario.

Create New Budgeting Spreadsheets within the scenario

Click on 'Create' to create a spreadsheet within the budgeting scenario

- Select Type (Budget or Revenue)

- On the 'Properties' tab, add or remove properties you would like on your spreadsheet.

- Click on 'Configure Filters' to filter accounts you want included on the spreadsheet (i.e only want accounts with OPU = 200)

- Enter a 'Sheet Name'

- Click on 'Save Sheet' to save your spreadsheet. A 'Confirmation Sheet Creation' box appears. Click on 'Create' to continue creating the spreadsheet. Once complete, an informational box appears stating the budgeting sheet created successfully.

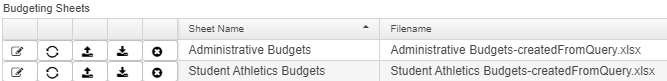

Scenario Grid

Once a spreadsheet is created in the scenario, it is displayed on the Budgeting Sheets grid. You can then access the spreadsheet using one or more of the following options in order to add proposed amounts:

- Click onto edit an existing spreadsheet (must use the existing PA-XXXX column to enter your proposed amounts)

- you can add (insert) or delete rows in your spreadsheet

- You can use formulas to enter your proposed amounts

- Click on to regenerate the sheet. This option is helpful if you made changes to the existing sheet (add/remove properties, change account filters, etc). Regenerate will update the sheet with the new changes, thus overriding the previous sheets settings. Existing proposed amounts will be removed.

- If you prefer to enter proposed amounts and/or make changes to your spreadsheet via Excel, click on to download the spreadsheet into Excel. Once the spreadsheet is completed and saved, click on to import the spreadsheet back into the scenario

- Click on to delete an existing spreadsheet you no longer want.

Upload Budgeting Spreadsheets into the scenario

Use the Upload option to upload outside spreadsheets into your scenario. These spreadsheet may contain proposed amounts.

- From the Scenario's Grid, click on Edit.

- Click on Upload.

- Enter a 'Sheet Name' and optional 'Description.'

- Click on 'Choose File' and select the outside spreadsheet you want to upload.

- NOTE: The outside spreadsheet must contain account code dimensions in separate columns with the proper column headers. You may also include the proposed amounts. The following rpd-json files may be downloaded and imported into the Redesign. They are similar to the SSDT Budget Expense and Revenue Expense template report definitions but have been formatted to include the proper columns headers in a spreadsheet format.

- NOTE: When entering proposed amounts, you must change the 'Next Year Proposed' column to 'PA-XXXX' (XXXX=desired fiscal year) in order for the spreadsheet to upload properly into the the budget scenario.

- Click on 'Start Upload' to upload the spreadsheet. Once complete, an informational box appears stating budgeting sheet was uploaded successfully.

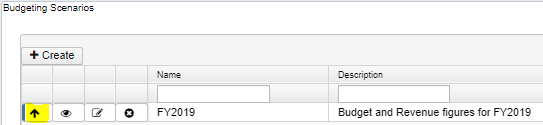

Promote a Scenario

Once a scenario is completed, it can be "promoted" to the proposed amounts field on the budget and revenue accounts. Promote includes all spreadsheets in the scenario. Once promoted, the accounts with associated amounts will appear in Budgeting/Proposed Amounts Grid as well as the Next Year Proposed Amount field under the accounts UI. The proposed amount grid is the working area where you can add/remove/edit the NY proposed amounts. When you do, it directly affects the NY proposed amount on the expenditure/revenue account.

Please note that once a scenario is promoted, any successive scenario that is promoted for the same year will remove a prior scenario's proposed amounts from the grid. For example, you create a scenario for HS NY proposed amounts and promote it. You then promote another scenario containing elementary NY proposed amounts. The HS NY proposed amounts will be removed from the grid (and from the proposed amounts fields on the expenditure/revenue accounts) and the elementary NY proposed amounts will be loaded. To prevent removal of a prior scenario's proposed amounts, we recommend creating separate worksheets (i.e. HS and Elementary) within the same scenario instead of creating separate scenarios.

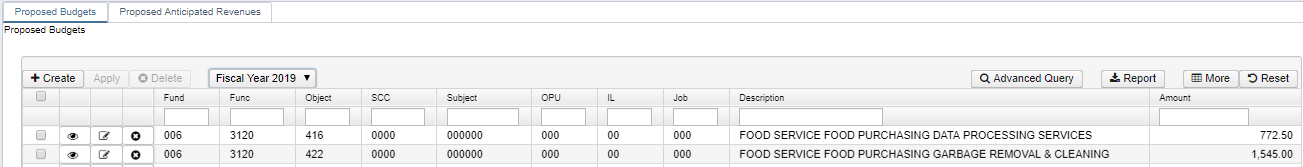

Proposed Amounts

Contains separate tabs for existing 'Proposed Budgets' and 'Proposed Anticipated Revenues' amounts in a grid format based on the fiscal year selected. Users can:

- Create a proposed amount in order to add it to the existing grid

- Enter or search for an account

- Enter a fiscal year (enter the full year CCYY).

- Enter an proposed amount

- Click on 'Save'

- View a proposed amount

- From the grid, search the desired account and click on to view the details of the proposed amount.

- Edit a proposed amount

- From the grid, search the desired account and click on to edit the fiscal year or proposed amount.

- Delete a proposed amount

- Per account: From the grid, search the desired account and click on to delete the proposed amount for that account. Click on 'delete' to confirm deletion.

- Mass Delete: From the grid, click on the checkbox for the proposed amounts you want to delete and click on the button to mass delete all checked accounts.

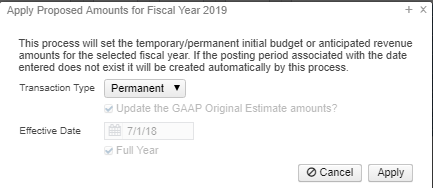

Applying Proposed Amounts

Once all of the proposed amounts have been entered for a fiscal year, click 'Apply' to apply them as initial budget and initial revenue figures.

NOTE: You cannot choose specific accounts to apply amounts to. It will apply the amounts to all accounts on your proposed amounts grid.

Choose from the following Transaction Types:

- If 'Temporary' is selected, 'full year' is checked by default. This indicates the temporary initial budgets hold true for the entire year. The 'Update the GAAP Original Estimate amounts' is checked by default. If you do not wish to set the GAAP Original Estimate amounts at the time you're applying your temporary figures, uncheck the box.

- If 'Temporary' is selected and 'full year' is unchecked, this indicates the temporary initial budgets could change during the fiscal year (i.e. Levy passes/fails.)

- If 'Permanent' is selected, 'full year' is checkmarked automatically and cannot be unchecked. This indicates these are permanent initial budgets. The 'Update the GAAP Original Estimate amounts' will be set automatically at the time you're applying your permanent figures. You do not have the option to uncheck this box.

- Effective Date: When selecting Temporary or Permanent transaction types, the date automatically defaults to the first day of the fiscal year selected.

Click on 'Apply' to proceed with applying the proposed figures as the initial budget/revenue estimates for the fiscal year selected.

Budget Transactions - Initial Estimates Report

The Public USAS Reports Library contains a report definition under the Budgeting section called 'Budget Transactions Initial Estimate'. This report definition is built so you can view changes made to initial estimates when applying proposed amounts for temporary (full year/not full year) and/or permanent transaction types. Adjustment type transactions are not included on this report. The 'Full Year' on the report indicates whether or not full year was checked when selecting Temporary transaction type and 'Replaced' indicates the temporary amounts were replaced with permanent amounts.