Transfers/Advances

Transfers/Advances is used to transfer money from one fund account to another or cash advances between funds. A transfer is considered a permanent movement of money, whereas an advance is expected to be repaid back to the originating fund.

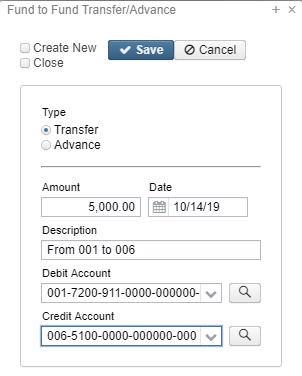

Creating a Transfer/Advance

- From the Transaction menu, select "Transfers/Advances".

- Click on

Enter in the required information. For the Debit and Credit Account fields, click on the down arrow to display the accounts transfer and advance accounts available.

The Legacy PO, Legacy Check and Legacy Receipt fields are not displayed when creating a transfer or advance. These fields contain data from transactions imported from Classic.

- To enter account codes:

- Use the drop down to select an account

![]() TIP: When filtering by account, you can use '02/' to filter on expenditure accounts or use '03/' to filter on revenue accounts.

TIP: When filtering by account, you can use '02/' to filter on expenditure accounts or use '03/' to filter on revenue accounts.

- Begin typing the account code to narrow down the selections

- Note: When typing the account code it is necessary to include the hyphens

- Use the icon to open a pop up window for the account search

- The account search will only show account codes available for Transfer/Advance transactions

- Begin typing the account code to narrow down the selections

- Click on to post the transaction, click on to not post the transaction and return to the grid.

Search/View Transfers/Advances

The Transfers/Advances grid allows the user to search for any existing transfers or advances by clicking on the filter row in the grid columns and entering the desired information. Click on any row of the search results to see a summary view of the record. Click on besides a transfer/advance to see the full details. The Advanced Search can be utilized by clicking on the in the upper right side of the grid.

Edit Transfers/Advances

Transfers/Advances from an open posting period may be modified. Only fields that are allowed to be edited will be displayed.

- Search desired transfer or advance on the grid

- Click on to edit the transaction.

- Make desired changes.

- Click on to save desired changes, click on to not post the changes and return to the grid.

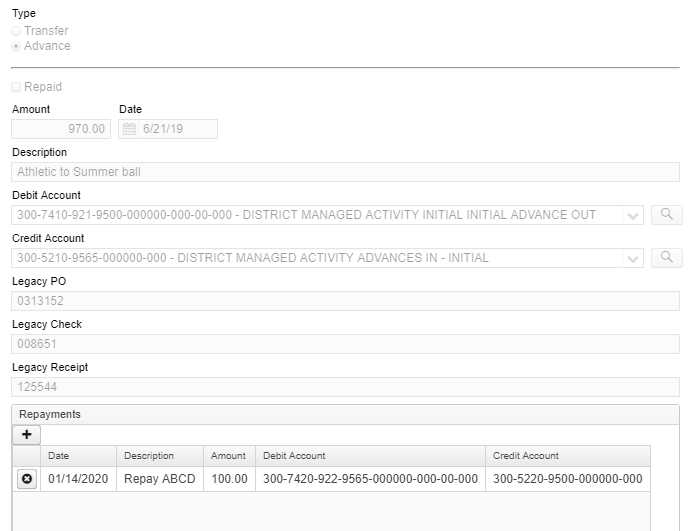

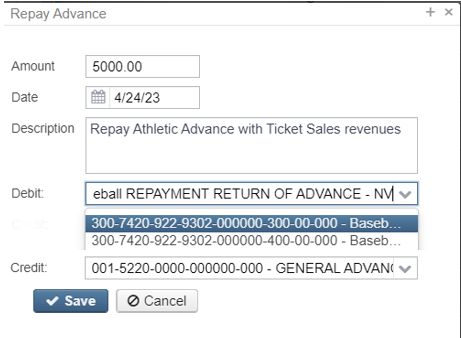

Repay an Advance

Only outstanding advances can be repaid. Outstanding advances will show as "true" in the Repayable column on the grid. Repaying an advance will process an expenditure transaction from the advance out (return) account and a receipt transaction to the advance in (return) account. To repay an advance:

- Click on the view icon for the advance you want to repay.

- Click the in the Repayments section to create a new repay transaction for that advance. Any previous repayments against the advance will also show in this section.

- The amount will default to the remaining amount on the advance. The date will default to the current date. Update the amount and date if needed and enter description of the repayment.

- Click on to post the transaction, click on to not post the transaction and return to the grid

- To remove a repayment, click on the line in the Repayments grid you wish to remove.

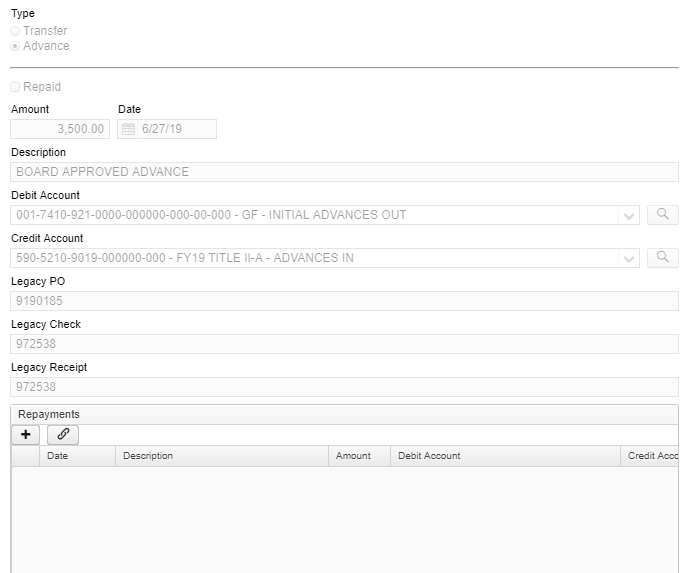

Link A Legacy Repay to an Advance

Repays made in Classic will need to be manually linked to the corresponding Advance using the link repay repay option. The SSDT Transfer Advance Activity Report can be run for Advance and Legacy_Repay types to help locate the repay for each advance.

For a more detail walk through on this process click here.

- Click on the view icon for the advance you want to repay.

- Click the in the Repayments section to link a repay transaction for that advance. Any previous repayments or linked repayments against the advance will also show in this section.

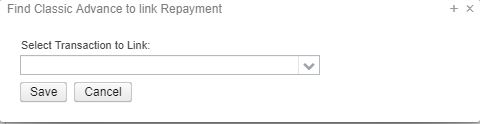

- The pop up will include a drop down to select a Legacy Repay to link.

- Select the appropriate transaction and click to save or to close the pop up without saving.

- To remove a linked repayment, click on the line in the Repayments grid you wish to remove.

More Information on Transfers/Advances

Backing out a Fund-to-Fund Transfer/Advance

A Transfer/Advance can be deleted if the posting period associated with the transfer is open and within the same fiscal year. Transfers/Advances from a prior year cannot be deleted.

Advance Function and Object Codes

When the advance is created, the advance out (initial) dimensions includes a 7410 function and a 921 object code. The advance in (initial) receipt code is 5210.

When an advance is repaid, the advance out (return) dimensions include a 7420 function code and a 922 object code. The advance in (return) receipt code is 5220.

No Time Restriction to Repay Advances

Per the Auditor of State's office the time restriction to repay Advances has been removed. Previously an advance had to be repaid in the current or next fiscal year. A repayment beyond that time would have to be processed as a transfer. It is up to the district to know how the specific advance is to be repaid. This will no longer be determined by the software.